We take ride share for granted — open the app, choose a ride, swipe, done. But behind that simple interface is a complex and fast-evolving battle of economics and experience.

The recent Mary Meeker chart of the Waymo market share in San Francisco was linearly extrapolated into the future by Peter Gostev:This begs a number of questions:

- Cost per mile: What does it take to deliver the ride?

- Perceived value: What does the rider get ?

- Price: What are consumers paying today for the value?

What It Really Costs to Move One Person One Mile

Most people don’t know what it really costs to run a ride. But under the hood, there’s a different story playing out — one where variable costs, fixed assets, and scale economics define who will win the future of mobility.

The current ride share leaders such as Uber and Lyft are variable-cost platforms where the drivers own the car and cover fuel, depreciation, and insurance, and the platform providers take ~20–30% of the fare. For the drivers, there is little to no scale efficiency per ride.

The Waymo cost base has high fixed upfront cost that are amortized over massive ride volumes. The cost per mile falls dramatically as usage increases.

Cost curves tell you who can win on price.

Which ride is actually worth your money?

Not all rides are created equal. Some offer luxury that doesn’t feel that luxurious. Others cost more but remove the driver entirely. Some are just cheap — and feel that way. So how do we make sense of all the options in rideshare?

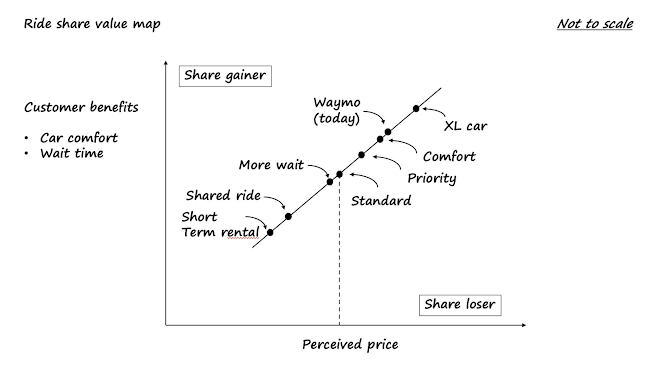

You can map this out using a simple lens: value vs. price.

- Price = what you pay per mile

- Value = what you get for it (safety, predictability, speed, comfort, novelty)

When plotted, this reveals how well each product serves its customer relative to its price.

UberX and Lyft remain the sweet spot for mass-market utility. Other models such as MILES short term rental of the myriad of offerings by the incumbents serve a wide range of niche demands - and these niches can be quite large on their own. Waymo today justifies its premium in some markets — especially for safety- or tech-conscious riders.

To wrap up: The industry cost curve tells us who can scale profitably. Value-to-price tells us who earns customer love.

Put together, and we get the strategic battlefield for the future of mobility.

No comments:

Post a Comment